A Energy Word ALERTS preview from 5/14/24

I wrote last week about cycles – mostly about mid-term cycles. These are the ones that help to inform us on our timing for entries and exits into energy stocks.

For example, we’ve often referred to the Commitment of Traders (COT) reports – which have been beautifully codified for easy analysis by John Kemp of Reuters – to show the cycles of speculative money from commercial and retail managers both in and out of crude oil futures. We’ve made some great timing decisions using this indicator over the years.

But we can never lose sight of the bigger picture – the larger-scale cycles of global energy markets over the years and decades. I want to talk a bit about that this week.

As I’ve been trying to reinvigorate the Energy Word, I’ve been working on crafting a presentation for ‘money shows’ that I’m intending to present this Fall. My reputation for expertise in energy investing is fading as I grow further away from the media work I did with Real Money, CNBC, Bloomberg and Oilprice.com. These days, I only rarely go on anywhere – and that is mostly by choice. As my presence fades, so does my subscriber base. I’ve had limited success with social media in growing the service and I think there is a more modern, targeted audience that can no longer be accessed using the ‘traditional’ outlets of cable TV and websites, particularly since Covid struck.

In any event, I’ve been creating and honing a 40 minute presentation on my ‘thesis’ of energy investment for these conferences, a relatively simple task since I basically wrote 3 books outlining different aspects of the subject.

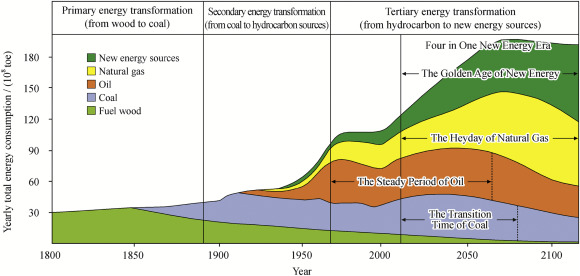

And it all comes down to the chart above. I think you’ve seen it before, it was done by some Chinese energy research group almost 15 years ago. Despite it’s age, I have found no other single chart that has better represented my thesis on oil investing for the long term.

Here are the instant takeaways from this chart:

1- the DEMAND for energy continues to GROW – (for our investing purposes, forever.)

2- Old energy technologies are only augmented by new technologies – and never entirely replaced

3 – New technologies fill inexorable demand growth with moments of exponential expansion.

Let’s take a quick look at each one of these to understand their full impact on our investment strategies.

Number (1) is self-evident. I believe that this representation is accurate and that energy demand will continue to grow, and even accelerate. Energy will have ups and downs of course, but long-term energy is a growth industry.

Number (2) is incredibly misunderstood and forms the basis for some of our best trades. For example, notice the green section representing fuel wood. You’ll see that even archaic fuel wood remains a tiny, but significant part of the global energy portfolio to 2050 and beyond. Now, look at the gray and brown sections representing coal and crude oil. Their contribution to the global energy portfolio barely weakens as time progresses. While they will tend to have a smaller PERCENTAGE of the global energy pie, the chart expects a fairly steady although declining contribution of both in supplied kilo-joules through 2100. Therefore, any global perception (and concurrent price dislocation) that crude oil is ‘finished’ and going to ‘go the way of whale oil’ as one energy advisor once predicted, will inevitably lead to an incredible investment opportunity when the ‘unexpected’ renaissance happens soon after. We’ve caught these kinds of one to three year trends for terrific profits in both Coal and Crude Oil over the years, including recently post-pandemic.

Number (3) is of course the ultimate investment opportunity. It invites a true ‘Google’ or ‘Apple’ moment to be in on an exponential growth train of emerging energy ‘tech’. Looking at the chart, the two technologies that are only beginning their expansion are renewables (which everyone expects) and natural gas (which few do). But both represent the kind of exponential gains over the long term that, I believe, we are currently on the cusp of experiencing. Neither of them, by the way, will be much affected by political administrations or policy changes, either here in the United States or globally. I believe these trends are all but inexorable, unstoppable, inevitable, much as the age of wood and coal has naturally progressed towards oil and gas.

Of course, the longer-term trends we are trying to target also require immense patience and still excellent timing to take full advantage of. And we have been slowly and carefully reallocating our energy portfolio towards these two ourselves, using the more mid- and short- term tools at our disposal to again time these entries.

But what should never be forgotten, as we do all this, are the long-term trends that must always be the guiding thesis of our investing strategies.

That’s all for this week