A FREE Energy Word Alerts Preview from late February — subscribe at https://dandicker.com/subscribe/

Analysis is great. You can pore over countless research documents that will minutely analyze any particular sector, or sub-sector or stock, delivering mountains of data points and leading to the de rigueur “overweight” “hold” or “underweight” assessments that moves so many investment dollars inside and outside of the major investment banks.

I have great respect for this kind of work. I read dozens of research documents a month, and the vast array of data is incredibly impressive (and expensive) to generate. But I will tell you, I never had a really good trade based upon research analysis alone.

I also rely upon my own instincts as a 40-year career trader in almost every investment I make, and when I’ve chosen to ignore those instincts completely, I’ve almost universally gotten punished in the markets.

Which leads us to two investment ideas today.

The markets have represented to me a current difficulty, as you well know. Through the many macro indicators that I have seen in the last months, I have been part of the “wall of worry” like many in the investment community (see graphic above), all while the S&P has continued to make new highs. Despite a market that continues to levitate on some very isolated sub-sectors like AI and other tech, I have still seen negative signs of a ‘last minute’ recession that has kept me, for the most part,on the sidelines.

But there have been isolated examples of stock price strength, which is frankly unexplainable in any analytical way. And if you’re a committed trader, and made almost all of your best trades by listening to those trader signals, you simply cannot ignore them, no matter what the numbers say.

Let’s start outside the energy box, with Bitcoin.

I have said over and over again that I don’t understand the first thing about Bitcoin. I’ll further tell you that whenever anybody tries to ‘explain’ it to me, I roll my eyes in disbelief. It might have an organic reason to exist and invest in, I don’t know – but I don’t get it.

But I do get how it’s being traded. Sure, there’s been the advent of the crypto ETF’s which have made the investment more accessible. But whether that alone explains the explosive action of Bitcoin since bottoming in early 2023, I’m not at all convinced. I’ve dabbled in Bitcoin before and had no position since the Spring of 2022. But the bottoming action I saw in the Fall of 2023 had me buying a small, rooting interest in it. When the same base forming action appeared in early 2024, I made an even larger investment, and just added again to the position in mid-February when this consolidation of strength appeared for the 3rd time.

This isn’t a newsletter advocating buying Bitcoin. It’s an example of an investment idea based upon nothing more than my trading experience. Why did I buy it? Because it acted well. Really well. That’s all.

Back to energy. There’s another sub-sector that’s begun acting really well too, for no reason I can fathom. Natural gas.

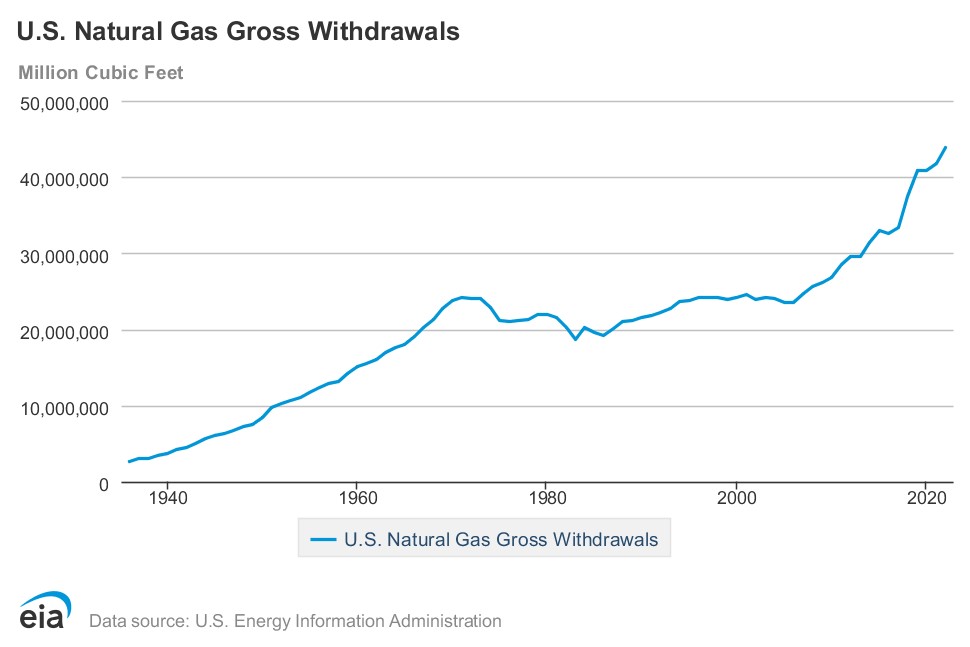

Not the commodity, but the related stocks. Natural gas prices are at the lowest historical level in decades. We know why – the weather has been unusually warm for two straight winters now. Stockpiles are overflowing, and production has not backed off at all in the last two years, actually accelerating spectacularly here in the US.

And the US isn’t the only place increasing gas production, despite the low prices.

But are natural gas stocks getting hammered by this massive increase in supply and equally large decrease in demand? They were. But, in the last two weeks, they’ve staged massive rallies from their lows, and have been holding those rallies in spite of the continued weakness of the underlying commodity.

Why? Like with Bitcoin, I could fathom making an explanation about the rotation of energy resources finally from oil to gas after a three decade competitive proof of the many economic and environmental advantages of the fuel – but I would likely be met with the same eye-rolling that I did myself when ‘rationalizing’ the parabolic rally of cryptos.

Why are natural gas stocks recently so strong in the face of such fundamental weakness? If you’re a trader, the answer is: I DON’T CARE. Why should you buy it? Because it’s acting well. Really well. That’s all.

I’m continuing my advocacy of rotating our primary fossil fuel investment from oil to natural gas, and also, despite it’s strength, giving out two of our ‘regular’ natural gas stocks to buy – or add to, as the case may be.

They’re both just acting too well. That’s all.

Buy RRC @$31.40 Sell Jun 35C @ $1.20 = (12/4×1.2)/31.40 = 11.5% annualized + possible $3.60 alpha upside

Buy EQT @$36.75 Sell Jun 40C @ $1.55 = (12/4×1.55)/36.75 = 12.65% annualized + possible $3.25 alpha upside

that’s all for this week