I know I scared the bejeezus out of the subscribers to my webinar this past Monday. After being probably the strongest public bull on oil prices for the last year and basically imploring them to get on the oil bandwagon for better times ahead, on Monday I expressed a slightly more sober outlook for oil prices going forward.

It’s not that I think oil prices aren’t again headed to triple digits – I do. I merely wanted to point out that the timeline for that move continues to lengthen, as oil companies find ways– somehow, some way – to not just survive, but actually revive in this horrible market.

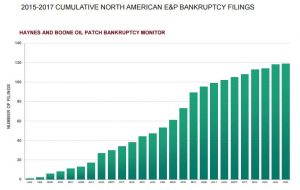

Let’s look at two charts – and I’ll give you a hint – one of them is not what I expected to see nearly three years into the oil price bust.

Here’s Haynes and Boone bankruptcy monitor – charting the number of new filings in each month for 2015 through the first two months of this year. As oil prices got bad in 2015 and companies ran out of money, the number of monthly filings went up strongly – AND CONTINUES TO INCREASE – even through 2017.

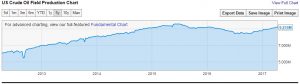

Now look at this more familiar one:

Here we see the recovery in oil production in the US beginning in late 2016 and through today, with oil production well over 9.2M barrels a day.

Wait, what? How can producers keep going belly up while production continues to ramp?

Producers would have you believe it’s their inestimable business savvy in top-line cost cutting and incredible technological advances. READ THIS and get a load of the self back-slapping credit that one oil CEO gives himself and his industry in weathering the oil price storm.

What baloney – Capex cuts and tech advances have helped of course, but mostly it’s been the constant influx of fresh money from investor funds and neat investment bank restructurings calmly wiping common shares to zero that have kept even the most egregiously over-leveraged and now bankrupt oil company pumping.

THE POINT I’m trying to make (which I may not be doing well) is that I DID NOT EXPECT this. I did expect the massive bankruptcies – which continue to multiply – but did not (could not) expect the complete rescue of oil production and the unfathomable INCREASE in production that has occurred during the middle stages of this ongoing crisis.

These two divergent, counter-intuitive trends in oil are confounding and are making energy investment a real challenge. Sure, we continue to get a global re-balancing that will ultimately ‘rescue’ oil prices and send them back towards triple digits. But, as for oil companies and oil stocks, they will likely continue to lag as they battle against still AWFUL margins at $50, $60 and even $70 a barrel and the anchor of still overwhelming debt.

It’s a Catch-22 that nobody saw coming: Marginal oil companies that have avoided and continue to avoid traditional LIQUIDATION bankruptcy instead INCREASE production, all while continuing to burn investor capital.

Of course, that slows the recovery of oil prices and extends the global rebalancing timeline. But more important to us as investors, it also makes most oil stocks LAG that rise in oil prices.

The most bottom line I can give you from all this – if you’re an energy investor – is that the oil stocks you choose right now for the coming energy recovery couldn’t be more critical, no matter how high oil prices ultimately go.

And that’s where my webinars come in.

Next one is APRIL 24th at 4PM – please use this link and join me.