I am selling a service, and all of you know that service is advising on energy investing.

That makes folks naturally suspicious that I might look to hype energy stocks all the time, trying to convince potential subscribers to sign on to the service, whether that moment is particularly good or bad for energy stocks.

It’s challenging to convince folks that what I’m seeing – today — represents one of the best energy setups I’ve seen in my 40 years of daily engagement with oil and gas. It really is. I know the human reaction is that I’m just another guy selling a service and hyping my product.

But what’s happening today is truly incredible, unprecedented and laced with investing opportunities.

Look, the pandemic destroyed a lot of global oil production as demand cratered. Once the pandemic subsided, we saw pent-up demand for fossil fuels simply outrun the ability of oil producers to satisfy them.

So, we’re starting with a supply deficit already in the market – and oil and gas is not like your kitchen sink tap — you cannot simply turn it up to make the water flow faster whenever you want. Rebuilding production in oil will take years after the decimation we saw.

Now comes the war in Ukraine. What it’s done to the oil and gas markets has been stunning. It’s created a unified European and United States effort to isolate Russian oil and gas from Western export. Just today the EU declared a planned ban on all Russian oil by the end of the year.

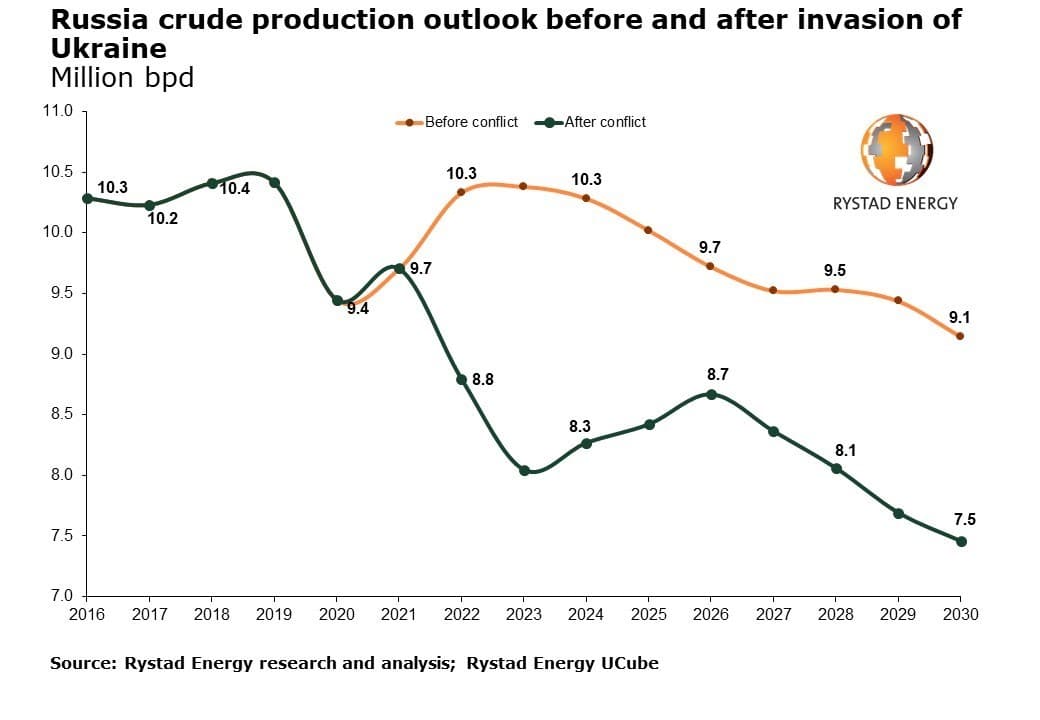

Russia produces 11 million barrels of oil a day – it keeps about 5 million barrels for it’s own use and sells the other 6, about 4 of which comes towards the West. Think first of what a loss of that ½ billion dollars a day will mean to Putin when the full ban goes into effect. While some of that oil will travel eastward towards China and India, it will go without sanctioned transport and at a steep discount. All of that will cut down on barrels sold and the amount the Russian treasury will get for them. Moreover, the loss of Western oil infrastructure is cutting into the absolute production ability of Russian oil. It’s already down a million barrels a day since April, and likely to decrease another million in the next 6 weeks.

Together, this is producing a massive 2 ½ to 3 barrel additional shortfall of supply into a global market that is already incredibly starved – and the price action of oil is so far not representing such a shortfall.

Why?

Mostly it’s because the markets are stressed themselves and are experiencing huge outflows of capital from the dual threats of rampant inflation and what looks to be certain recession.

Now – oil won’t go unscathed if/when we head into recession. A recession might counteract much of the inflation pressures on price that I’m laying out here for you from Russian oil curtailment.

Hell, I’m just an oil guy – I’ll leave the broad economic trend analysis to others.

Here’s what a recession won’t do.

It won’t change the fundamental nature of the oil supply/demand picture. Oil is running well shy of where demand is, and the Europeans look very serious indeed about cutting Russian oil and gas completely from the West. Whether the whole world goes into recession, that’s a fundamental oil supply/demand picture the likes of which I haven’t seen in my entire career.

And indicates some opportunities the likes of which I haven’t seen in my entire career either.

I’ve already come up with more than a few of these, which Energy Word subscribers are using to lock in stellar returns for 2022. I expect they will continue to lock in even better returns for 2023, recession or not.

Now, if all this looks to be just another pitch to hype energy stocks – I understand. Like I said at the start of this, it’s hard to convince folks that what I’m seeing today is special.

But it is. It’s very special.