While world market investors are mired in overwhelming fear of the ‘most well advertised imminent recession in the history of the world’ (shout out to the Grit Newsletter), you might be missing one of the best opportunities that still remain in oil and other commodity stocks.

Two investing plays made tremendously positive moves in 2022, turning a terrible investing year for most into a stellar one for those who found them –

The first was energy, and even more broadly commodities and commodity stocks, which had been on the bottom of the investment returns list for most of the previous 12 years. Investors who found this trend early in 2022 were rewarded with enormous gains on blue chip oil and gas stocks, ‘saving’ an investing year when the major indexes were down around 22%.

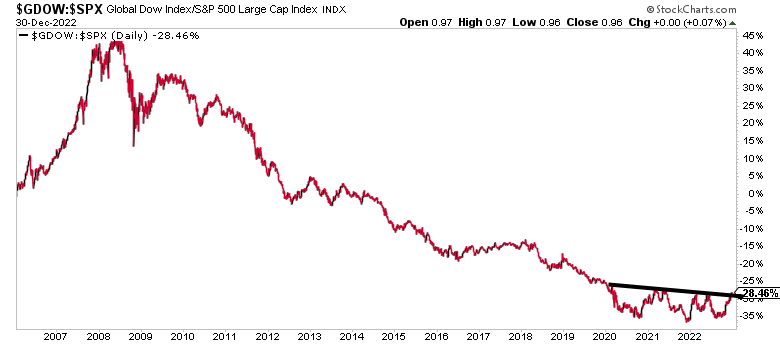

The second turnaround, and one that went mostly unnoticed, was in indexes outside of the United States. For the first time in a long time, Euro and EM market indexes not only kept pace with US stock markets in 2022 (not hard to do, considering the tech disaster), but they surpassed the US in almost all cases, particularly towards the end of the year.

Again, we have been so used to European and other EM indexes doing poorly relative to the S&P that this turnaround went mostly unnoticed, or was ignored as part of the ARK sector meltdown. But, like energy and commodities, EM markets that under-performed in recent years have had years previously with tremendous, outsized gains compared to US stocks. A turnaround in this relative value of markets continuing in 2023 could mean a lot of ‘pent-up’ under-performance in Euro and EM shares are about to begin to ‘catch up’. There are several macro themes that will impact the future performance of both commodities and EM markets, and the fate of these is certainly up in the air; including weakening of the US Dollar and the possibilities of a Ukraine/Russian armistice.

But for our subscribers at the Energy Word, we have been faced with two overwhelming questions: First, what’s our outlook for those global trends to cooperate in 2023? And second, where could we find outsized value in oil and gas stocks (and other commodity stocks), considering the tremendous run these issues have already had in the last 14 months?

Oil went above $120 in March of 2022 while at the same time, Exxon-Mobil (XOM) barely reached $90 a share. Now, oil hovers around $80 a barrel, while Exxon flirts with $115 a share. One of these two is currently wrong, it seems to me (and I would bias strongly toward oil being grossly undervalued) – but no matter how you parse it, it’s tough to make a convincing call that Exxon still represents deep value. I use Exxon to make a point throughout the sector – even if we could be convinced that commodity stocks would have another stellar year in 2023, we’d still like to find some examples that had some serious room to run to take advantage of it.

Hence, we began to focus on some of the already depressed valuations represented by EM and Euro commodity stocks for some better ideas to capitalize on these two combining trends. From a fundamental point of view, the stocks I’m about to suggest have lots of very good reasons why they’ve under-performed in recent years, outside of the relative weakness of their country’s market index. Please don’t bother to make a case of why these are terrible companies and therefore terrible investments – I could make those just as well and likely better than you. These are suggested as speculative holdings inside of a well-rounded energy portfolio, and not entitled to any kind of life changing investment.

First up is Petrobras (PBR). This Brazilian oil company is 30% state-owned, and from that standpoint alone it’s always been a difficult portfolio choice (think of Chevron’s (CVX) experience in Brazil – and no, I don’t think it matters much whether Bolsinaro or Lula is in power). Still, Brazilian off-shore oil prospects remain one of the best established, long-term quality new production oil resources on the planet. With the systemic supply issues plaguing oil and the general oil company focus to reinvest capital these days into stock buybacks and dividends as opposed to traditional E&P development, this resource will only gain in potential value for the company. Unlike Exxon, Petrobras has not continued to rally past it’s highs in March of 2022 when it hit $16; it currently languishes under $12 a share.

Next is Vale (VALE), the copper and other metals mining company. Also Brazilian (and also complicit with government mismanagement), it is still one of the Copper stocks that have only recently begun to react to the interim lows and subsequent rally that copper prices had in 2022. At the Energy Word, we took advantage of lows hit during the Fall last year in other domestic copper stocks, yet feel that the commodity resurgence is far from over. Vale is a play designed to capitalize on our EM turnaround trend as well as this rebound in metals prices.

Oil and commodity strength is now a well-established trend, one we think is far from having run it’s course. Combining that with the recently emergent resurgence in EM and Euro stocks could lead to some picks that could supercharge returns in 2023. While we don’t plan on making either Petrobras or VALE a core holding of our portfolio, they both represent interesting ideas to take advantage of those concurrent trends through 2023.