Lots of varied inputs hitting me in the last week, and while none of them seem overwhelming, together they describe a market that looks almost exactly as we have allocated for – and therefore has been a confirming indicator to me of our strategy and process. Let’s talk about it.

Oil has been about as dull a market as we have seen in quite a while – and this despite two rather enormous geopolitical developments that, in other times, would certainly have rocked the oil markets. First, we had an assassination of a Hamas leader in Tehran by the Israelis on July 31st, and another in Lebanon, both acts that were clearly expected to generate a response from Iran and a possible widening of the Middle East conflict between Israel, Hamas and Hezbollah. Instead, while the markets waited for a response, Tehran has seemingly chosen to wait. In Russia, Ukraine turned a major corner in the war by opening up an offensive in the southern Kursk region. With Ukraine now wishing to move offensively, and not merely try to defend land, this war takes on a much more serious tone.

To both of these frankly monumental geopolitical developments, the oil markets have all but shrugged.

In contrast, the fundamental numbers in the oil markets look well supplied. For the mid-term at least, it is clear that OPEC+ increases in supply will not be overtaken by the demand increases expected for the rest of 2024 and perhaps at least half of 2025. In the United States, there are continuing signs of more shale oil coming out of fewer wells , making rig counts all but meaningless, and the recent breakthrough from Chevron of high pressure pumping success in deepwater wells, a technology that caused the boom in shale oil is now being successfully brought to underwater drilling.

While both of these developments have the potential to spectacularly increase oil production efficiency, neither of them, on their face, is necessarily ‘good’ for the price of oil. With demand only slowly rising, the efficiency increases of US wells, both onshore and underground, will compete with the volume increases from OPEC – and likely keep prices, at best, flat.

Yes, oil companies will make more profit from a barrel of oil, but what price will that barrel be?

Since the ‘mini-crash’ in the market that turned out to be a buying opportunity (we caught a little natural gas and copper), oil stocks have been like oil itself – blah.

Not so for our more focused sectors of natural gas and renewables.

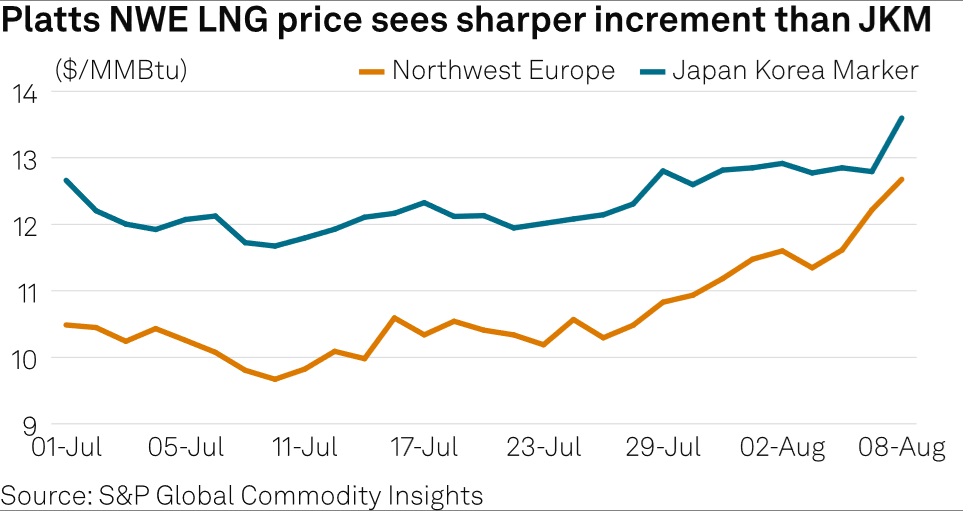

Range resources (RRC), for example, is up nearly $3 a share or almost 10% since that dip, and we continue to get indications that stockpiles in natural gas in Europe are no longer robust as they were during the panicked response to the Ukrainian invasion in 2022. In response, LNG prices have been slowly but surely ratcheting higher (chart below).

This is a market that could easily spiral upwards with any kind of colder winter late this year, or an unforeseen change in the pipeline situation through Ukraine, a possibility that is currently not being much considered.

Bottom line, as far as fossil fuels go, I remain far, far more bullish on the upside possibilities of natural gas than oil.

Maybe I’m even more bullish with our renewables, which had an even more interesting two weeks.

All three of our bellwether stocks, NextEra (NEE), First Solar (FSLR) and Constellation Energy (CEG) were up between 15%-18% since the ‘mini-crash’ and all of them are reaching some technical ceilings they should have tremendous trouble in breaking. But so far, they haven’t broken.

They might – but I have no intention of selling even one share.

Maybe that’s wrong – These are precisely the set-ups that traders would look for to take some profits off the table. There’s a clear FED angle here of a rate cut that everyone is convinced will be ½ point instead of a ¼ – that would seem to be a clear negative on all these stocks that they are expecting the larger cut now. Even a rate cut of ¼ point might be perceived negatively. They also have a clear political angle here, as Kamala Harris has been moving ahead in the polls and the Democratic convention is beginning. There’s got to be some ‘liberal tree-hugging’ hype in these stocks now, isn’t there? Surely.

But I’m still unwilling to lighten up even a little.

We haven’t overpaid for even one share of any of these three, and I don’t know if I’ll be able to do that again if I play around with this position. And I still believe that 2024 is the tipping point for the transition to renewables, and so few stocks are available to take advantage of this trend, if it (continues) to turn out to be true.

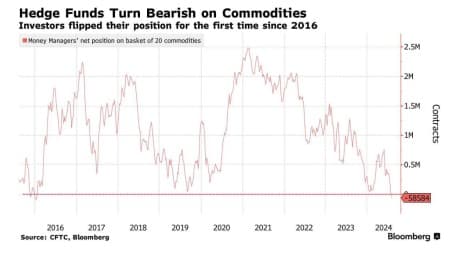

Finally, and for the best current play – Copper is beginning to move higher again, as we thought. Traders have been selling commodities fiercely since 2021 (chart above). Incredibly, the number of short contracts held by traders in the ‘basket’ of 15 commodity markets is greater than the number of longs.

Really?

Not only is this exceedingly rare when it happens, it’s almost immediately wrong. You know how I love to play the other side when all the traders seem to be on one side of any trade – and particularly the SHORT ONE.

If you don’t have some copper, you should probably get some….. is what I’m saying.

Buy SCCO @ $101.

That’s all for this week