It’s summertime and the big traders’ machines are running rampant back at the office, while their owners are mostly languishing on the beaches of the Hamptons and Italy.

Don’t think that doesn’t matter.

I’ve always found the action in markets to be more volatile in the summertime. In fact, when I was trading futures on the floor, I made a larger percentage of my yearly income during summer month trading. For a floor trader, volatility is very good.

For investors, not so much.

The anxiety surrounding RECESSION is all that is moving markets these days. There’s a lot more than that going on, of course, particularly in our energy markets. But no matter – the investors and advisors and financial writers are all aware of the 10-year rally in stocks that seems to be coming to an end and wringing their hands about what they imagine could be a really nasty, nasty comeuppance for the markets.

I’m no economist, I just observe, report and trade.

First, stocks are already down more than 20% from their highs. That makes it already about an average recession move. Combine that with a true bear market and the average retracement is 34%. So, another 12-15% more to go, in a worst-case scenario?

I’m not saying that’s how it’s going to turn out, I’m saying that’s the most average outcome that’s finding absolutely no support with many analysts right now, despite some very encouraging jobs reports.

It’s all about RECESSION.

Meanwhile, from an energy perspective, you’d be hard-pressed to find a better set of circumstances for loading up on oil and oil stocks here at around $100 a barrel.

Traders have been bailing on long positions in oil for a few weeks right now, and the level of long commitments is historically low. Spoiler alert, when the traders all think the market is this bad, they’re almost invariably wrong.

Biden’s been convinced (by Macron) that trying to get the Saudis to drop more barrels on the market is a fool’s errand. He’s apparently listened, won’t try to strongarm MbS, and has rebranded his trip to the Middle East as a “reset”.

Libyan production is already down 400k barrels from the state-run oil control power play going on over there and looks to go towards 800k in the next two months. Have another 1m barrels withdrawn from this supply short market? That can’t be bearish.

The JCPOA with Iran has exploded apart and the US is back to applying sanctions. Iranian oil is headed for Asia, but even so, that won’t help the global supply chain for crude any.

And of course, there’s Russia. JP Morgan went so far as to speak about a scenario of Russian oil withdrawal from the West that might push oil prices to – get this – $380 a barrel (how do they come up with THAT figure?)

In the US, despite the high prices of gasoline, miles driven has decreased only slightly from historically high numbers. Here’s economics 101 – if you don’t use less (drop demand) and the supply remains limited, you’re more than likely going to see prices continue to go up.

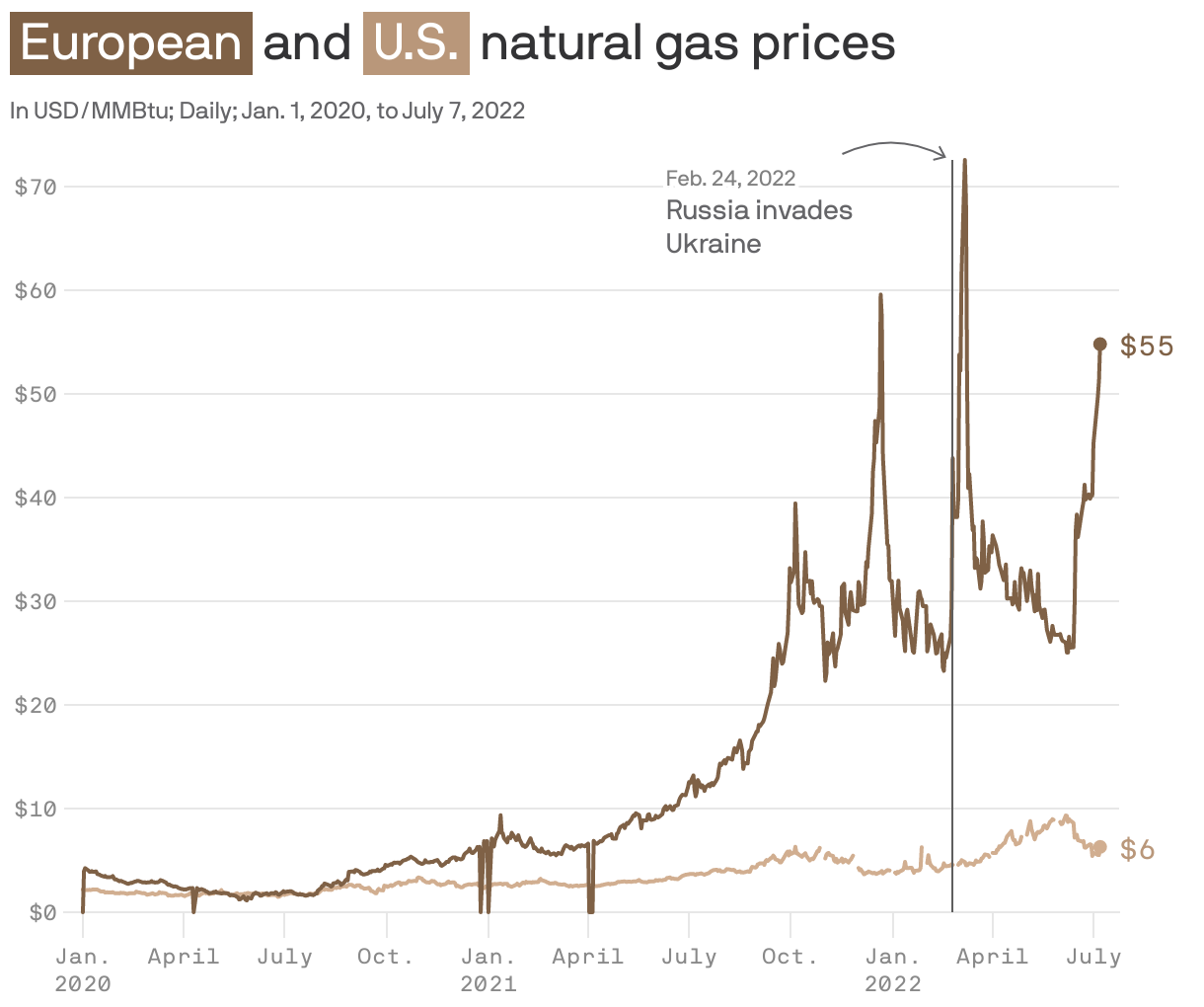

On the natural gas side, it might even be more bullish. European prices continue to soar as France makes plans for a complete end of Russian natural gas imports. Nord Stream 1 seems to have avoided the worst possible shutdown possibilities, but throughput is still down 40% there for now, with winter coming. LNG global trade grew by 4.5% in 2021, well BEFORE the Russia/Ukraine crisis began. You want to guess what it’s going to be for 2022? Europe continues to scramble frantically for natural gas.

Bottom line is, that I want to be buying oil and gas stocks today.

Sure, they could go lower first. No doubt that the machines will amplify the anxieties of the next proposed Fed rate increase or the perceived imminent crash of the housing market, or Bitcoin’s or Twitter.

But, I think that, like in years past, when the traders get back to their offices after Labor Day, the markets will take on a whole less frantic, anxiety-ridden tone. And particularly the oil and gas stocks we buy today will look awfully good in October.

Want my best energy picks in today’s volatile market? SUBSCRIBE TODAY using THIS LINK and receive my top picks on Tuesday morning before the open. Only $25/month.

dan@dandicker.com