Here’s a FREE PREVIEW to this week’s Energy Word Alerts —

Consider subscribing and be in on the winners (like EOG, XOM, SCCO etc. discussed here) BEFORE they rally

https://dandicker.com/subscribe/

There are all sorts of traders and there are many ‘styles’ that can be successful. As for me, you may have realized that I’m not a trader who trades for ‘big’ moves that are mostly destined not to materialize.

Probably the most famous traders in the world are these types – the ones who ‘bet’ that the rails are going to come off, and they do (See “the Big Short”) or others who see the ‘new normal’ before anyone else and makes a killing on the upside (See ARK’s Cathie Wood).

You will notice that Michael Burry famously couldn’t do anything but lose money after his fabulous short of housing derivatives, and closed his shop, and Wood in 2022 is way underwater with her hedge fund after her tremendous initial successes.

It can be very profitable to be right in a ‘big trade’ – enough to set you up for life if you do it correctly. Unfortunately, these ‘big scores’ are rare, even among the most talented, and are likely to leave ‘regular’ retail investors broke long before they might get lucky enough for that ‘big’ score. Remember, you only hear about the big winners, while the losers are never spoken about — and there are thousands more of those.

Instead, I choose to try to hit singles, keep the batting average up and leave the home runs to braver folks. It’s not nearly as sexy, but it does what I need it to do (and I assume you): retain wealth, deliver steady alpha and protect against a market disaster of no one’s prediction.

Why do I tell you this in this week’s newsletter?

It’s because my style tends to get more conservative as our predictions get closer to being realized – and those are the moments when I tend to become a contrarian of even my own well planned long-term trading ideas. In other words, don’t read this newsletter and imagine I’m not still bullish on oil and oil stocks — I most certainly AM.

But, I look out at the markets today and I see two things that bother me – a LOT:

1- The general markets are rallying on the hopes of a more dovish Fed decision in December, and a brief turning away from draconian rate hikes. Sheesh, even the talk of a 50bps rate hike in December, instead of a 75bps hike has investors giddy – spiking the Dow 1200 points last Thursday.

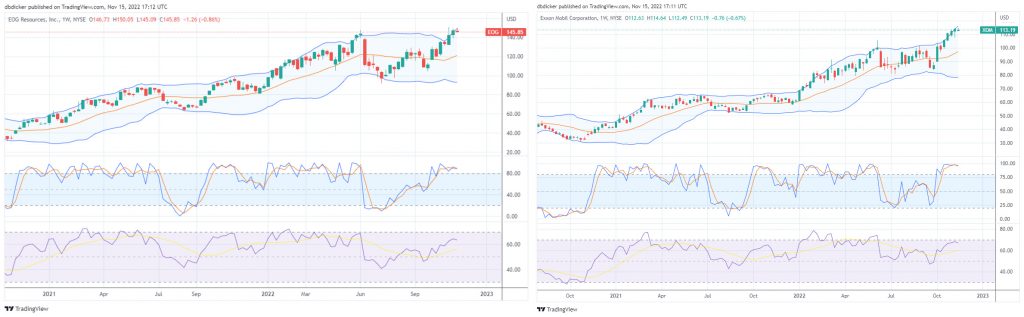

2- Beat up Technology investors have been rotating into energy stocks. WHY? Because they’re the only sector that’s been winning in 2022. However, this rotation has outrun the current oil price – by a LOT. While there are predictions of triple digits returning to oil soon (heck, I’m making them myself – if for next year), the prices on stocks like Exxon (XOM) and EOG Resources (EOG) are more in line with oil prices at $120, not $90.

Have a look at the two charts of the two previously mentioned oil stocks above – not that I’m a slave to charts, hardly. But I look at these and boy, if I didn’t know what stock was listed at the top, I’d be far more likely to SHORT them then buy them. They are undoubtedly in long-term bullish moves, but look currently WAY overextended.

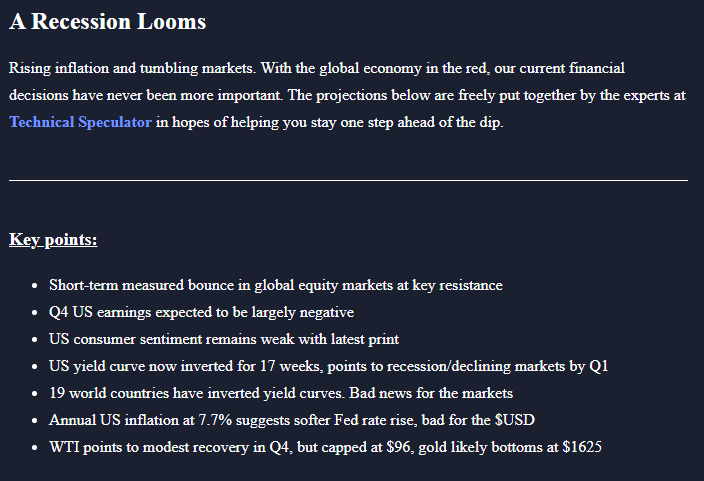

Add that up with a stock market that seems to have forgotten that inflation is still 7.7% and a recession doesn’t end with stocks down a mere 15%, and you’ve got me looking to protect our gains and particularly protect against quick losses. Call me a wimp, but I hate not booking profits I worked so hard to make.

It’s not that I don’t think oil stocks can continue to rally through the December meeting, of course they can.

But a single reminder of Recession angst (see below), or a small indication that Putin is looking for a deal to get out of Ukraine (for the reasons here, here, here and here), and we’ll see oil and oil stocks get a big bite quickly taken out of them.

Bottom line: I’m buying nothing in the next weeks and playing defense. For example, I have December calls on EOG shares at $135, and would not mind in the slightest if they are exercised against me.

Other shares that look overdone include refiners based on a temporary diesel shortage, and oil services, which are reacting to the low number of remaining DUCs and rig counts that continue to slowly increase. Helmerich (HP) continues to outperform.

I’d rather be buying Nat gas – as the weather looks ready to change and take gas prices up with it. But even those stocks aren’t terrific value right now and are worthy of waiting on.

And, speaking of waiting – if you missed the nice opportunities I offered on Copper (SCCO) and rare earths (MP Materials), I think you waited too long – these don’t strike me as nearly the value they were a few weeks ago either.

That’s all for this week