We’re entering a secular bull market for fossil fuels

My apologies for the delay on this letter – Columbus Day put both the webinar and the newsletter back a day

The big energy story this week is not here in the US, but abroad where energy shortages continue to plague Europe, China, and India.

This matters a lot for us as US investors.

In Britain, the issues are dire, with the need for governmental rationing of power almost certainly necessary. When choices need to be made whether to heat homes to a toasty 70 degrees or mandate a high of 63 – and choose whether to allow the baker to stay open or the smelting oven, you’ve got a real energy crisis.

The Chinese are not under the same constraints as in Europe, where retail marketers and distributors of power are capped by the government on what they can charge consumers. These types of controls are of course doomed to failure, not because the governments cannot offset costs that are being delivered to consumers, but because they can no longer be competitive in a very competitive marketplace for limited energy resources.

The Chinese are going to win this battle –— and the war, for as long as it goes on.

Here in the US, our questions as investors are clear:

1 – is this power crisis coming here?

2- how long can it sustain itself in Europe?

And maybe most importantly

3- what does this so far foreign energy crisis mean for our energy investments?

First, have little fear about this kind of rationing of power coming to the US – we have particularly ample natural gas resources that can be tapped before we are forced into any kind of supply crisis. For answer number two, it seems to me that this kind of supply shortage and competition for energy can in fact last for a VERY long time.

There are those who are looking at the Russians as the culprits, or at the Pandemic, or at the history of Europe and China backing away too quickly from fossil fuels and relying too much upon ‘not ready for prime time’ renewables to take up any energy demand slack that might arise.

I think we’ve proven that renewables are decidedly NOT ready for that, either in Europe or in Asia, where the Chinese and Indians are reaching furiously for more and more dirty COAL.

But we know that this supply shortage of energy elsewhere in because of the last 6 years of supply destruction – both here in the US and in OPEC, brought on by the poor discipline and oil gluts of American producers, and the low prices that resulted.

Now that half of US producers have been decimated, and the other half (including the likes of Pioneer and Chevron) won’t easily fall into the trap of opening spigots just because oil goes over $80 AGAIN –

Now is when a real, and systemic oil shortage – one that will reach everywhere – will really begin.

I will say that I saw this coming, although I didn’t expect it to this heightened degree until the Spring of 2022.

No matter – we are in a secular BULL MARKET in oil – and a concurrent bull market in oil and natural gas stocks that is really JUST AT THE BEGINNING.

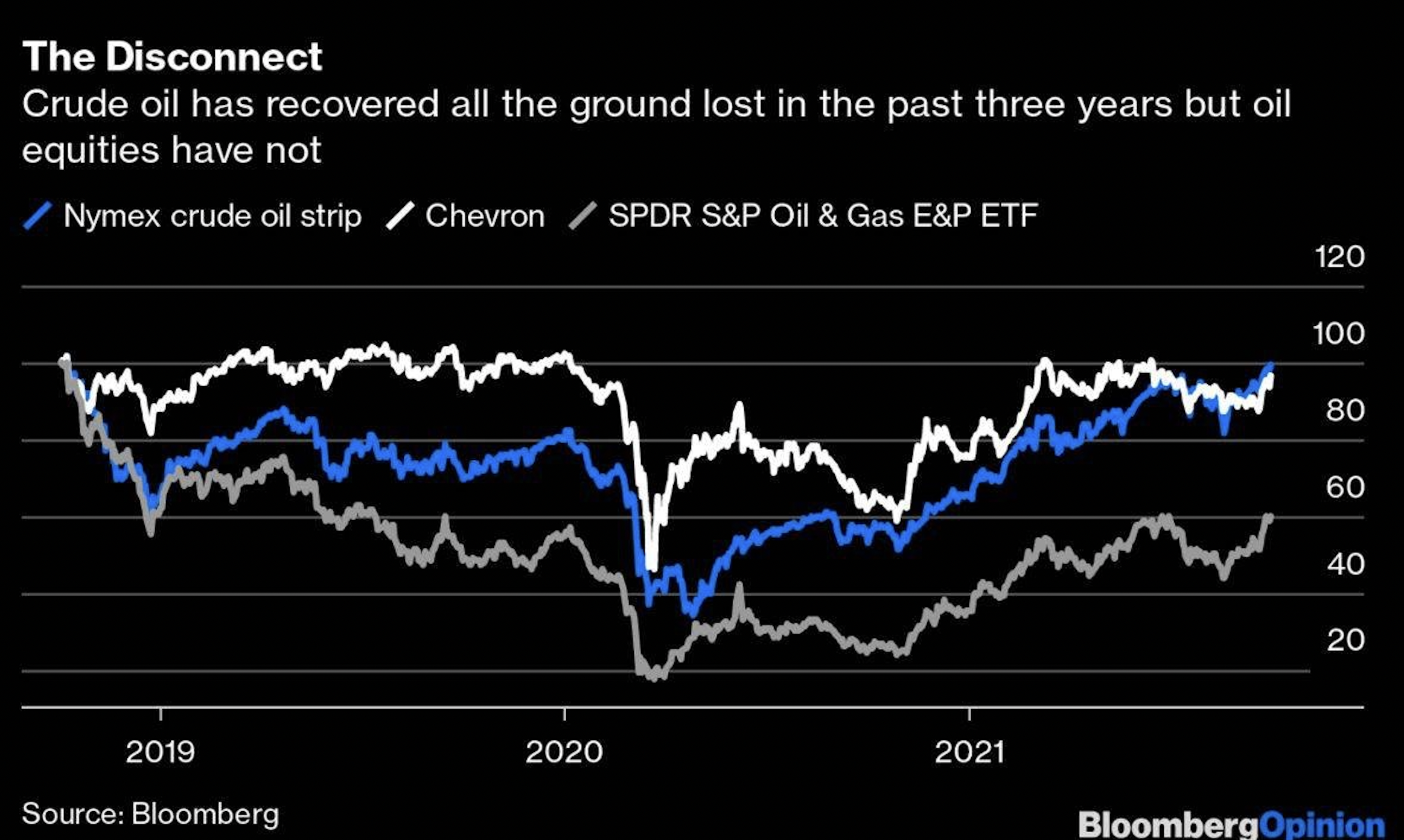

Because even though oil is at $80 and headed above $100, oil stocks are not yet NEAR where they should be for the lofty prices that are ahead.

And that means that even though we know the value to be had in certain oil majors and independent E&P’s, most of the rest of the investment world doesn’t quite get it yet.

But they will, they will.