In the second week of November, oil prices were pushing near $84 a barrel. Today, in the second week of December, they’re barely holding on to $70.

What happened?

Well, we could say Omicron, and we’d be right – but that doesn’t really explain it well, at least from a fundamental view.

I mean, the threats to the oil markets from Fed tightening and lessened bond buying remain exactly as they were in November, so that hasn’t changed. Certainly the fundamentals of a limited supply of oil as the global economy continues to grow is at least as serious today as it was in November, maybe even more dire. Indeed, there are strong indications that not only are US oil producers continuing to show discipline by not overproducing, even though prices are above $70 – some are actually afraid of overheating the marketsbecause of the limited production.

OPEC is also (rightfully?) convinced of the upwards trajectory of oil. Their recent meeting ‘concession’ to continue with 400k barrel increases for January didn’t seem to affect their bullish tone. Why? Well, numbers show they didn’t add the 400k barrels of their promised new supply in December, and will most likely fall even further short in January.

What they say they’re going to do doesn’t have to be what they actually do, and every move OPEC makes kind of looks like they’re helping keep oil prices down to keep the American President happy, but actually are helping to move them up.

The Saudis have even increased their benchmark prices to China and the US – showing that they’re convinced oil prices aren’t headed further downwards.

So, what’s different? Why are we $14 lower now than a month ago?

We’re back to Omicron, and the threat of lockdowns crushing growth, aren’t we?

I’d say that’s true, except that the Alpha and Delta variants didn’t have a similar impact on oil prices, even though Delta remains the most dangerous variant to date, at least among the unvaccinated.

Omicron appears to be more transmissible than Delta, but far less deadly. Most of the gains in the stock market in recent days has been due to the realization of this. It’s beginning to become clear that Omicron is a step on the road to Covid-19 mutating into nothing more deadly than the common cold.

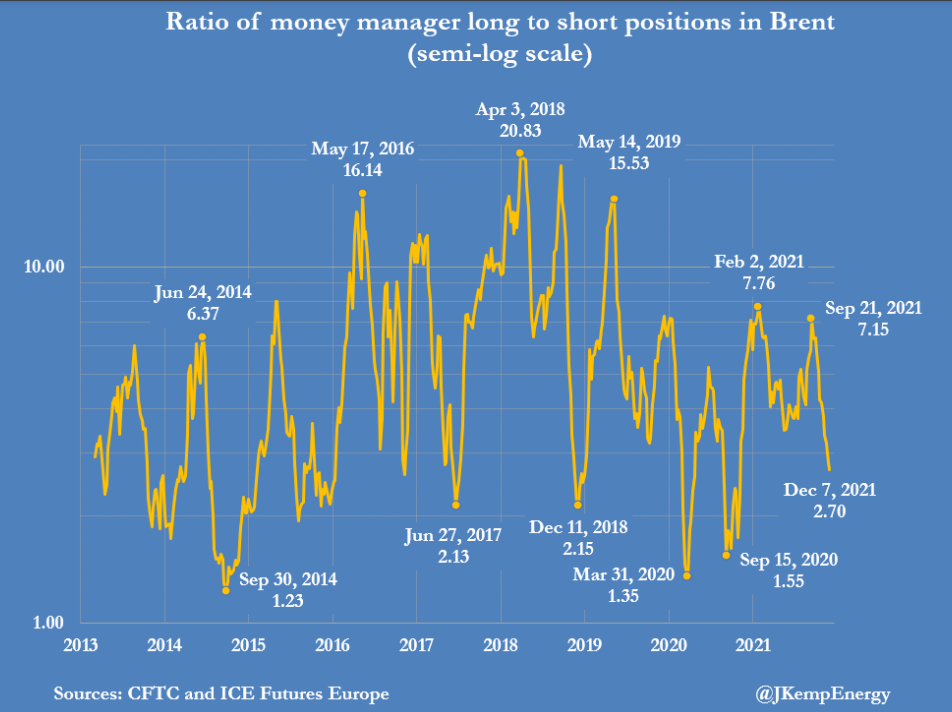

Have a look at this chart – and my answer to the disconnect we’re seeing:

My specialty as an oil trader hinges on reading and understanding this chart correctly – specifically the money moves of oil traders and what they mean. And what I know that most analysts ignore is that markets can be moved much more substantially by traders even than by the fundamentals.

So what do I see here? I see enormous trader longs in the market as of late September and early October, which coincides with the highs of the oil market. Since then, oil longs began to liquidate, but that became an avalanche in light of the reports about Omicron.

I want to be clear: It’s not necessarily a high in the markets when trader longs reach their peak and start declining, but it’s usually a very good sign. But what I am saying is that unexpected bearish news, like the outbreak of another variant, can cause that dribbling of liquidation to turn into a tsunami, forcing down prices to unreasonable levels.

This seems to me to be the real difference between the $84 in November, and the $70 today. Traders are still not done leaving the market, and will need time to regroup before they are convinced again that oil can withstand Omicron and the governmental responses it will inspire.

One thing I learned, which I should have known long ago, is that you cannot take a liquidating market for granted – and the power it can add to a downside move. I promise not to forget my own lessons again.

Moving forwards, however – Part of the power of recognizing the continuing liquidation of traders is understanding as well that an interim bottom is likely to be in soon, if it’s not already.

And that means that an opportunity, like Santa Claus, is also likely just around the corner.