Normally in my weekly blog, I like to make a quick take on the energy stories I’ve found the most important in the last week. Then, I normally exhort many of you to join me in my bi-weekly webinar THE ENERGY WORD for more in-depth analysis.

Not many of you have listened to the second part of my plea.

Well, this week, I’m reversing the lineup of my weekly blog – and for a reason:

On August 7th, I sent an email alert to my ENERGY WORD subscribers, telling them of the opportunity in oil stocks I thought I saw coming.

Then on September 1st, I sent another email alert, while I was away on vacation, advising subscribers that the opportunity I outlined to them earlier in the month was going to be ACCELERATED by the Gulf Coast storms.

Those alerts turned out to call the interim bottom in oil and oil stocks. Not to pat my own back too avidly, but I couldn’t find another analyst anywhere willing to get positive on oil stocks when I did. Not one.

Of course, these webinars and email alerts try to do more than just make general calls on the energy markets – because not every oil stock is going to react the same to changing energy trends. With my ENERGY WORD service, I also try to give firm ideas on WHERE TO LOOK for the best individual opportunities that are appearing.

I am alone – again – in believing that this recent revival of oil towards the top of this year-long range is much more likely to result in a breakout than in another retracement.

Why? Well, you know I’m going to tell you to come to this Monday’s webinar on September 25th at 4PM to find out.

Now for the stories to keep an eye on:

Number one is the latest short-term energy report from the EIA. They are consistent in their belief that shale oil production in the US is going to accelerate again in early 2018, a projection I think will turn out to be woefully wrong. Reading closely in this latest report is not a projection, but the fact of current declining production the EIA ascribes to Harvey. And while it’s true that the storm shut down some production in the Eagle Ford shale and the Gulf of Mexico, the pace of restarts in both places tells of a much more important long-term story.

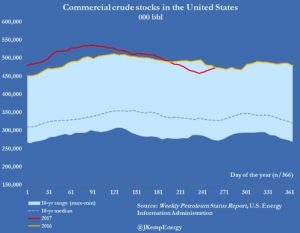

Last, a chart of weekly stockpiles sent completely askew by the hurricanes.

Do yourself a favor, and ignore this last uptick. In the end and as I said in my email alerts and on Bloomberg TV, the end result of the storms will hinder upstream production much more consistently going forward than downstream refining into gasoline and other products.

As Lily Tomlin would say………….”And that’s the truth………bleeeeeech!”

Have a great weekend,

Dan

Get to my website and sign up today. DanDicker.com