“This preview of my premium ALERTS letter went out on MONDAY when the markets were at the depths of their move — consider what you might have done with this perspective at that point in the trading day and consider joining with an ALERTS or PREMIUM package and never miss out on Dan’s timeliest guidance”

If it’s not already obvious, this week will have no webinar. The coronavirus has laid me pretty low, and although I’m on the upswing, I’m not ready for prime-time. Sorry. I’m going to hope this Monday newsletter will suffice this one time, written when the markets are presumably in ‘crisis’ – the long-awaited retracement, or crash, or whatever you want to call the move the markets have been making the past several days – has finally arrived.

I’m an energy trader, but of course we still still need to evaluate the overall markets. My opinion is that, yes, stocks were overvalued and needed this sell-off, but I’m not convinced that this is the “big one” and the markets are about to go into a multi-year swoon. In fact, I’m pretty sure that this move we’re seeing over the last several days is somewhat overdone in the short-term, even IF the mid-term trends for stocks is going to be downwards.

And then, it is a question of WHICH stocks are doing the selling. There’s little doubt that our energy stocks have been a shelter in this storm, although today’s action has been pretty rough on everyone. Still, the lion’s share of words being written on the financial blogs and spoken on CNBC and Yahoo are about the tech stalwarts of the last several years, the NFLX, TSLA, MSFT, GOOG, etc. stocks that have been the big winners and now are assuming the biggest brunt of this downturn. In that regard, I’d say we’ve done well – or at least as well as an already 11% drop from the highs can be considered well.

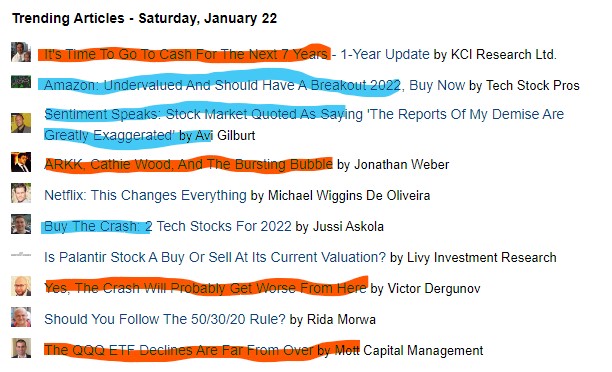

It also seems that the financial media are not quite sure what to make of this sell-off either. Here’s a daily list I received from SeekingAlpha of the top 10 trending articles of the day on Saturday:

“The world is ENDING” articles are highlighted in Red, the “Buy ‘em NOW” articles in Blue.

Both sides are as hyperbolic and click-baiting as the other – there are an equal number screaming ‘get out’ as ‘get in’ and yield little in the way of direction for retail investors.

So, let’s shoot the middle, as most of these ‘crises’ turn out to be: Let’s assume for the minute that neither the world is ending, nor that the once in a lifetime opportunity to load up on Salesforce is upon us. Then what can we say?

Let’s say that we’re witnessing a reckoning for stocks that a likely three-time interest hike during 2022 would indicate as natural after 10 straight up years for stocks. Inflation will be blunted by those rate hikes, but also asset values will get blunted as well. Let’s also assume that the stocks that have led the markets for the past several years – the ones with the stratospheric multiples – are going to have a relatively bad time of it for the mid-term. Those seems to me to be a pretty easy assumptions to start with. Let’s also assume there will be a strong initial retreat of capital in stocks in general (crash) and also assume that the capital that remains will be looking for further rotation out of those tech stocks and into dividend-paying materials and consumer staples stocks and other hard assets.

Like oil and gas.

No matter what the stock market does, the energy markets do continue to show value on a fundamental basis. There is a crisis continuing in Europe, there are oil and gas stockpiles getting smaller here in the US, the latest from Russia is that they will completely run out of spare capacity in 2023 – and it’s getting clear that the Saudis may not be far behind. Unemployment continues to drop as do the numbers of infections from Omicron in the major city centers of New York and Los Angeles. I see the world through trader’s eyes, and when I see the government buy an extra 500M covid tests to distribute to the public, that strikes me as a ‘top of covid market’ sign – I’ll bet anything that in two months the Feds will have a warehouse with an extra 420M covid tests that no one needs. (and I’ve got Covid right now!).

If this is then a stock market thing, and less of a fundamental market thing, then we should be good with our energy stocks. Not just good – very good. If all indications are that oil demand is going to continue to rise while the supply chains are going to continue to be under stress, then Exxon and Chevron and EOG and Range Resources seem to me to be a terrific place to continue to invest for the next year or two – if not much more.

And Exxon still pays 5%. Bottom line: Not only am I not recommending a retreat from energy stocks today, I think there are opportunities you should take to buy oil and gas a little more cheaply this week than we could two weeks ago.

That’s been the plan, and it’s been working – let’s stick with it.

That’s all for this week.