The one thing that could alone sink a second Joe Biden term isn’t age or the merits of Bidenomics.

It’s gas prices.

Don’t discount this one, important piece of inflation news as possibly the downfall to Biden’s reelection. The winner of the next presidential election might have nothing to do with Trump and his legal woes, whether he is convicted on any of the four indictments in front of him. It could be just as simple as the number blaring above every gas station at nearly every busy street corner across America.

It doesn’t matter that the President has very little to do with what gas costs. Believe me, every American President wishes he could have a long-term impact on gas prices – and keep them low. That doesn’t mean that they don’t get regularly blamed for them when they go up, no matter who happens to be running the country at the time.

Gas prices are a political problem, and a dangerous one, because of the psyche of the average American. There is an entitlement surrounding gasoline that is unique to the US. The American public has had an almost endless and cheap supply of gasoline from the 1920’s through the 1990’s. Although the markets might have changed since, American minds haven’t. It is considered a birthright among American drivers to own whatever kind of car (or monster truck) they want, drive them when and where they want, and do it cheaply.

And whenever they can’t, they’ll blame it on the occupant of the White House.

All Presidents, especially those since the 1973 oil crisis, have been forced to respond to this political time bomb – whether they had any practical tools to affect gas prices during their terms or not. Sometimes their efforts were successful in altering the markets enough to keep oil prices low for a time; sometimes they weren’t. President Bush went to Saudi Arabia in January 2008, as oil prices surged towards $140 a barrel to ask for production relief from OPEC, but was met without success – only the financial collapse in 2008 managed to corral $140 a barrel prices. President Trump sent his Secretary of State, Mike Pompeo, to visit Saudi Arabia as his midterms were approaching in 2018, and got OPEC to abandon their production cuts. In what seemed like this transaction’s other side, the US signed an $8.1b deal of sensitive armaments with the Saudis in May of 2019. Joe Biden also visited the Saudis in July 2022, but did not receive any production cuts as a result, despite the friendly ‘fist bump’ meeting with the Crown Prince.

But Biden managed to find two other tools that helped him keep gas prices low for the 2022 midterms, despite Saudi intransigence: The Fed and the Strategic Petroleum Reserve.

I’m not sure any President would want the Federal Reserve to go after inflation as violently as Chairman Powell did, hiking 11 times since March of 2022. But it did have the benefit of putting pressure on prices of many of their inflation targets, most notably oil. Oil reached a high in March 2022 of $130 a barrel – and finally dipped below $65 in May of 2023, before staging its most recent price recovery above $90 a barrel. Much of that collapse of oil and gas prices in 2022 and into 2023 is directly related to the success the Fed had in quashing gas prices through interest rate increases.

Biden’s other success in helping make gas prices decline during this period was through releases from the Strategic Petroleum Reserve. In March of 2022, Biden’s Department of the Energy announced a 6-month release of 180 million barrels from the SPR and another 26 million barrels in February of 2023. With US oil demand alone at 20 million barrels per day, it would seem that even 200 million plus extra barrels of oil spread across a one-year period should have had a limited fundamental supply effect on its price.

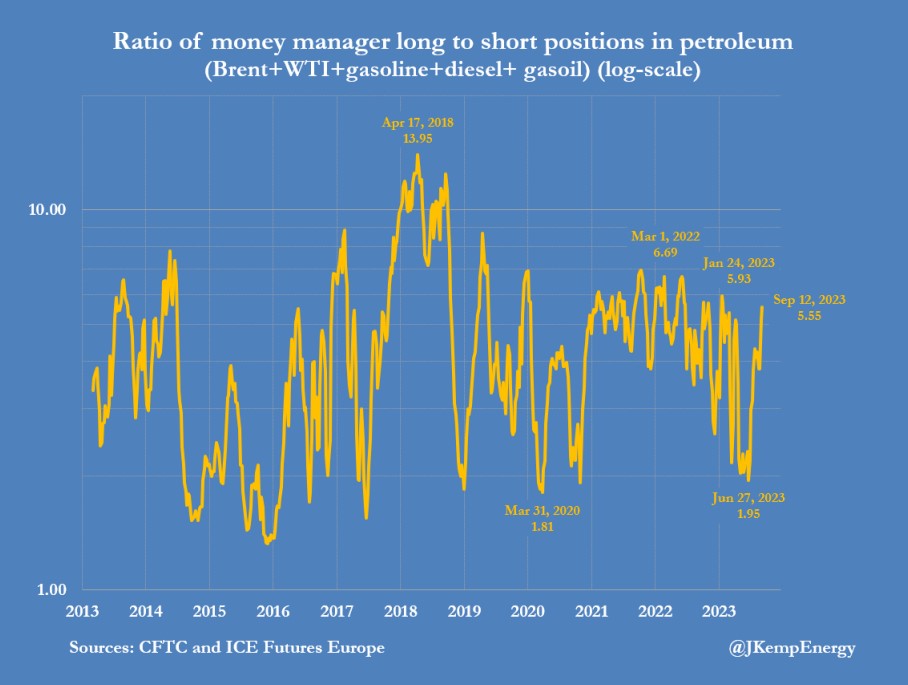

In practice, however, this was definitely not the case. Speculative futures traders in the markets became very wary of taking on bullish positions in oil when the United States government was, in essence, ‘betting’ against them. By standing guard on futures markets and always threatening to add oil barrels into the cash markets at any time of their choosing, the US Treasury and Department of Energy were literally standing on the other side of the trade of most non-commercial futures markets participants. The proof of this effect is in the charted ratio of long to short positions shown below. While this ratio among non-commercial traders continued to fluctuate, the ratio long/short highs of 6.69 since 2019 were seen on March 1, 2022, right before the SPR release announcement, and their interim lows were just recently seen at 1.95 in late June of this year. During that time, announcements of further SPR releases had an instant effect on traders, chasing them out of longs and crushing oil prices.

For all intents and purposes, the US government was acting as an oil trader itself, using the SPR to ‘manipulate’ oil prices down – definitely not the job it was designed to do.

The problem right now for Joe Biden when it comes to gas prices and the upcoming 2024 election is that he has very few tools that are left for him to effect any price weakness in oil, even for a short time.

The Federal reserve has moved interest rates from basically zero to 5.5% in 18 months through 11 increases and few economists, much less Fed governors, think that interest rates can be raised much higher without crashing the entire economy into recession.

Similarly, Biden’s SPR releases, and unwillingness to refill the reserve, has left the reserve with 354 million barrels remaining as of June 2023, down from 630 million barrels as of two years ago, a 44% reduction. It is unclear whether Biden could confidently reach further into the SPR in 2024 without completely dismantling that reserve’s primary purpose of energy security.

You can see why gas prices might be the one negative factor that Joe Biden may have no control over in his bid for reelection, and how dangerous that could be for his chances of winning.

Oil prices have been creeping higher on the back of Saudi and Russian production cuts. US production has been slowly increasing because of the recently higher prices, but it seems those new barrels might not reach the markets in time to head off triple digit oil in 2024. So what can Biden do?

On of the market participants who has been consistently adding oil into the global marketplace in 2023 has surprisingly been Iran. The Biden administration has relaxed some of the Trump-instituted US sanctions, combined with creating closer diplomatic ties, culminating in a recent swap of prisoners. This has all indicated a cooling of tensions between Iran and the United States, at the same time as tensions have eroded between the US and the Saudis (and of course Russia because of the Ukraine invasion). Is it possible that the Biden is hoping that Iranian barrels will help quench a coming supply shortage that will emerge in 2024, just as the Presidential elections are heating up?

We’ll have to see. But Biden needs to do something new if he wants to be confident in winning reelection. It seems likely that neither the Federal Reserve nor the SPR will be available to help him keep gas prices low this time around. Most analysts, including me, are expecting triple digit oil prices in 2024, and history has shown that it’s a political nightmare to try and get re-elected, particularly when there’s ‘pain at the pump’ and gas prices are soaring.