I’m a trader, not a journalist covering the energy space, nor a consultant or energy analyst.

I don’t compete with either of these groups of experts. Their resources and access are far beyond mine.

But what they can’t do, and have never done is invest successfully using all of that wonderful data – that’s what I do.

Sometimes I think the only advantage I’ve got – to put it crudely – is that I’ve learned how to call bullshit.

This week provided a great example of that. Here’s a chart from my 2015 book “Shale Boom, Shale Bust: The Myth of Saudi America”:

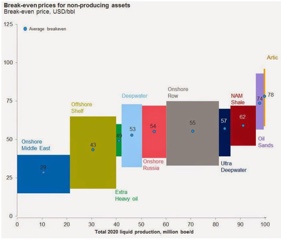

This was Morgan Stanley’s take on the 2020 supply of oil, which they guess will be slightly over 100m barrels a day. In it, they take further guesses on where that supply would come from – if you’re wondering, the red box towards the right is the interesting one – NAM (North American) Shale.

Now, where MS wasn’t guessing, at least in 2015, was in the average break-even prices for each source they cite – less than $30 a barrel for the Middle East conventional oil, near to $75 for oil sands, and an average of $62 a barrel for shale. Remember, this is the AVERAGE. Half of the needed shale supply to meet 2020 demand – at least according to this chart – is above $62 a barrel. If you’ve read my book, you know that the marginal barrel price is what we’re after here to figure out where the market is headed. That is the most expensive break-even cost that fulfills the demand requirement, or the LAST barrel to fill the demand tureen. Understanding this concept alone is worth the five bucks to buy and read my book.

But I digress – let’s just say that everyone’s fine if oil is trading at $62 to keep it simple.

Now, for the last two and a half years, as oil’s price has fallen from above $100 to below $30 and then to recover today near $50, oil companies have in complete unison crow’ed about their incredible advances in technology to cut their production costs to the bone. On nearly every transcript of conference call I read, CEO’s claim their break-even prices to have improved to $40, $30 – some claim even $25 a barrel now.

I call bullshit.

I don’t doubt that improvements have been made. Shale drilling is still in its infancy. But I’ve seen oil companies do this far too often – hiding development costs already spent, highlighting only the most efficient projects while shelving the less efficient ones for the moment – and creating optimistic presentations of sustainable profits at $50 oil for oil analysts and their shareholders to lap up.

Uh, bullshit.

READ THIS NOW – and see how the realities of break-even costs ultimately can’t overcome these fantasies of oil company CEO’s. When the big boys like Exxon, Shell and Chevron are scrambling to turn a profit and pay dividends at $50 oil, you know there’s still some very hard times ahead, particularly for the smaller players.

The horror for oil companies is hardly over now that oil has ‘recovered’ to $50 – that disaster is also just in its infancy. Nor is the industry going to thrive with oil staying here or even moving to $60 a barrel, as most analysts and both the EIA and IEA are predicting. Something entirely different is going to have to happen than most everyone – journalist and analyst alike – is thinking.

Being nearly alone in first calling bullshit and then figuring out how to profitably take advantage in your investments is exactly what I do in my interactive webinar series every other week. If you’re not part of that, consider signing up for my next one this MONDAY April 10th.